nanny tax calculator texas

Well answer all your questions and show. Good news though NannyPay offers a low-cost and up-to-date.

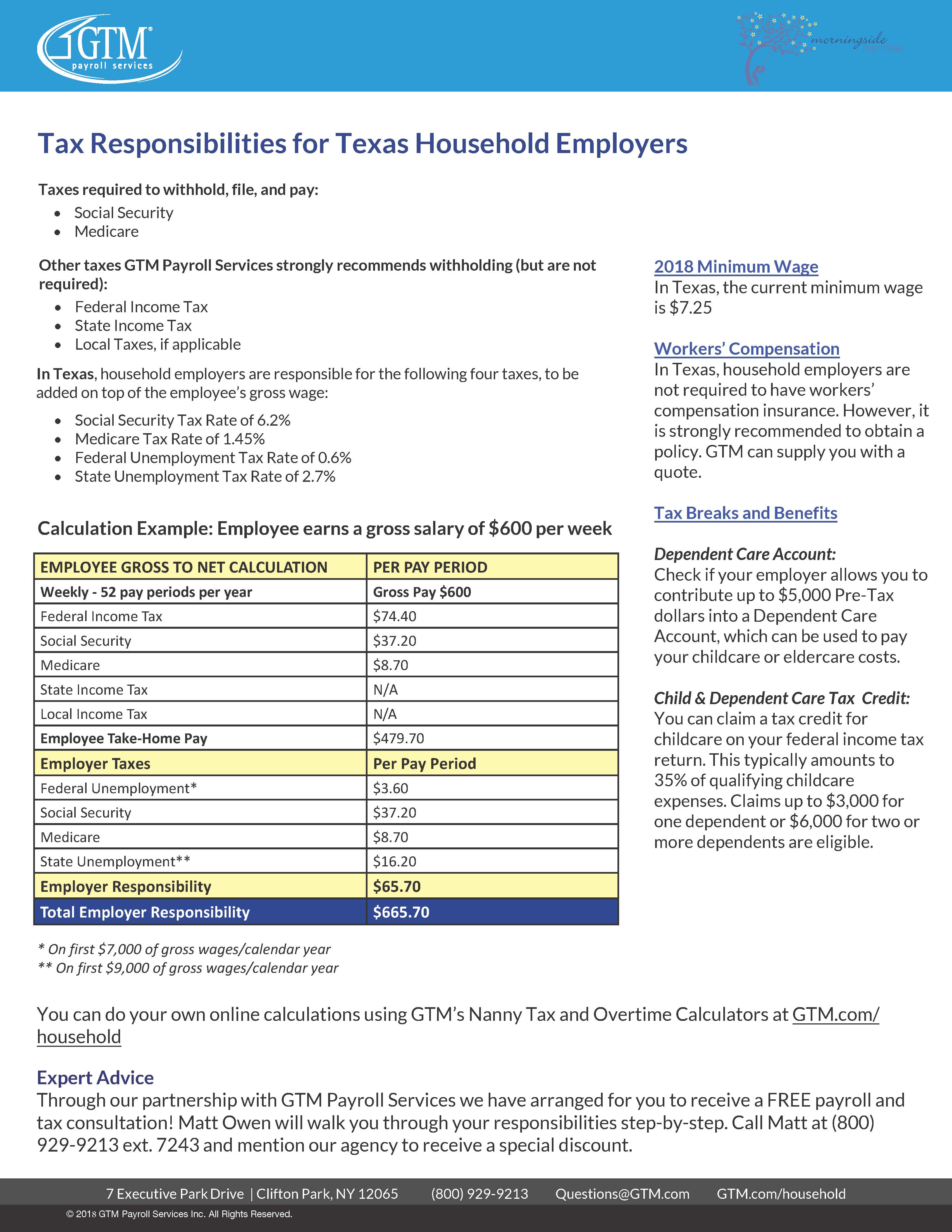

Texas Nanny Tax Rules Poppins Payroll

Gross vs Net Tax Calculator Employees Information Payment Frequency Weekly - 52 pay periods per year Bi-Weekly - 26 pay periods per year Semi-Monthly - 24 pay periods per year Monthly -.

. How To Create A W 2 For Your Nanny. For tax year 2021 the taxes you file in 2022. Using a calculator that is not current may cost you and your employee when filing tax returns and other reporting documents.

Employee State Tax Settings. Youll need an employer identification number EIN if youre responsible for paying a nanny tax but this doesnt have to be a challenge. How to File and Pay Nanny Taxes.

Call 800 929-9213 for a free no-obligation consultation with a household employment expert. Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. Nanny tax calculator texas Saturday March 5 2022 Edit.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. Understand your nanny tax and payroll obligations with our nanny tax calculator. If you hire a nanny or senior caregiver in Texas learn about all the state household employment tax payroll and labor laws you need to follow.

Key in basic data like the hourly wage and get an estimate of how much you will have to pay per month and per year. GTM Can Help with Nanny Taxes in Texas. Nanny Tax Hourly Calculator.

The Nanny Tax Company has moved. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. Put values into the required input fields marked with an and optionally. Nanny tax calculator texas Thursday March 17 2022 Edit.

It is intended to provide general payroll estimates only. Contract Template Contract Contract Agreement What You Need To Know About Nanny Payroll Taxes Nanny. Nanny Agencies in Texas.

Form C-20 or C-20F for annual filing. For specific advice and. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home.

Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. You are responsible for federal employment taxes when you pay household workers as little as 1000 in a calendar quarter or when you pay any individual employee age 18 or over 2400 in. You may have seen this type of calculator on the internet when trying to look for information on how to pay nanny tax to the Internal Revenue Service IRS.

Use our nanny payroll. Nanny Tax Hourly Calculator. This is a sample calculation based on tax rates for common pay ranges and allowances.

Employers that do not file and pay. These rates are the default rates for employers in. Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator.

On a quarterly basis. The nanny tax calculator for 2015 and 2016 taxes you will need to enter your nannys gross weekly pay and the number of weeks you paid your nanny. You can also print a pay stub once the pay has been.

Cost Calculator for Nanny Employers. Ad Easy To Run Payroll Get Set Up Running in Minutes. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two.

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. Ad Easy To Run Payroll Get Set Up Running in Minutes. Note that if your nanny goes over.

This calculator is a. Your individual results may vary and your results should not be viewed as a. TWC Rules 815107 and 815109 require all employers to report Unemployment Insurance UI wages and to pay their quarterly UI taxes electronically.

Taxes Paid Filed - 100 Guarantee. Taxes Paid Filed - 100 Guarantee. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

How Much Should I Hold Out For Taxes On 500 A Week In Texas I M A Nanny For A Family And They Don T Take Taxes Out Of My Pay Quora

How Does A Nanny File Taxes As An Independent Contractor

Ohio Paycheck Calculator Smartasset

![]()

Texas Nanny Tax Rules Poppins Payroll

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

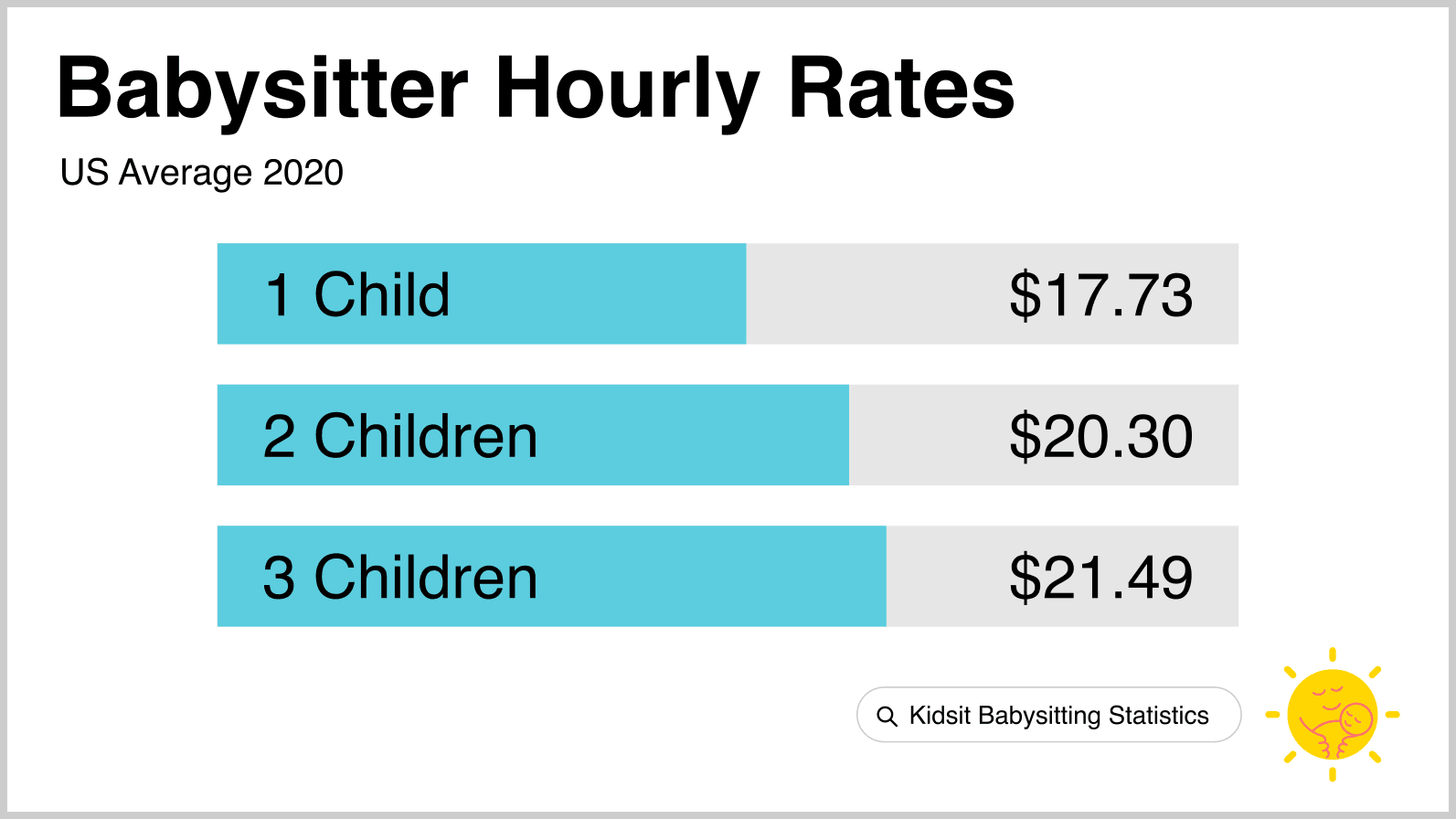

Babysitting Pay Rates How Much Should You Charge

A Nanny Asks Questions About Form W 2

Nanny Tax Calculator Gtm Payroll Services Inc

The Right Time To Put A Nanny Or Caregiver On The Books Hws

How To Create A W 2 For Your Nanny Nanny Tax Tools

Pin On Business Templates Free

Nanny Tax Payroll Calculator Gtm Payroll Services

How To Get Your Irs Employer Number Nanny Tax Tools

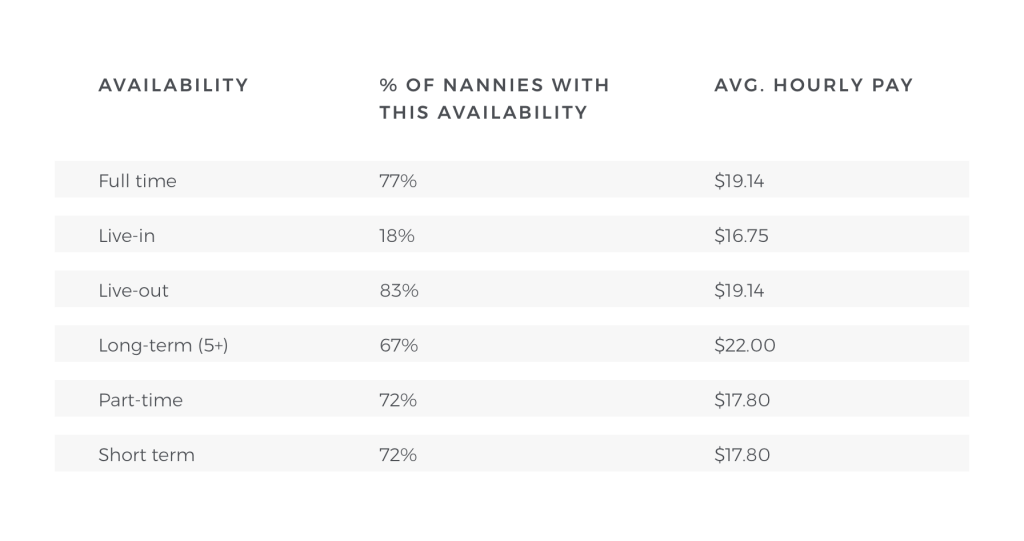

How Much Do I Pay A Nanny Nanny Lane

2018 Nanny Tax Responsibilities

What Is The Nanny Tax Nanny Tax Tools

How To Get Your Irs Employer Number Nanny Tax Tools